Share your details here

Request Personalized Demo

Share your details here

Request Personalized Demo

Our Proud ERPNext ZATCA approved solution champions Fatoorah E-Invoicing

Multi-Company and Multi-Branch Setup

Sales Invoices, Credit Notes, and Debit Notes

B2B and B2C Clearance and Reporting

Instant ZATCA Clearance and Reporting

Multi-Currency Support, SAR, USD, and More

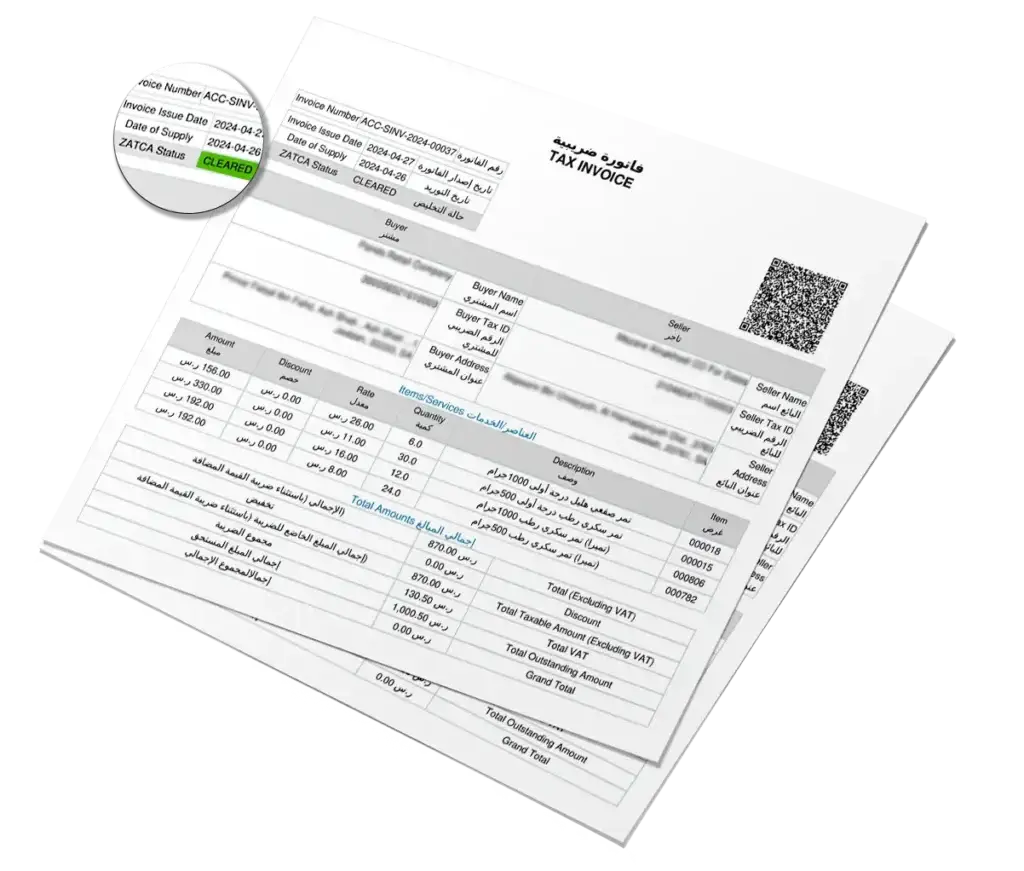

QR Code and XML Embedded PDF/A-3 Print

VAT Summary and Detailed VAT Reports

Multiple Point of Sale (PoS) Registration

Host anywhere -Frappe Cloud or Public Cloud or On-Premise

Secure Cloud Archiving Over 5+ Years

Fatoorah Simulation Portal Testing

Secure and Digitally Signed by Fatoorah

FATOORAH (E-Invoicing) workflow with

ERPNext ZATCA Phase 2 E-Invoicing

ZATCA Approved

Invoice Print Formats

Default print formats in ZATCA-approved PDF3/XML format, including Seller and Buyer details in both Arabic and English. The invoices also feature embedded QR codes and XML

Seamless ZATCA Compliance with Beveren Software and ERPNext: Your Proven All-In-One Solution

All-In-One Solution

ERPNext is a comprehensive solution for businesses with Accounting, Inventory, Procurement, Sales, CRM, and more

Go Live in a week

Test and validate on the Fatoorah Simulation Portal and go live in no time. ERPNext is easy to set up and integrate.

Year Round Support

At Beveren Software, we support your business 365 days a year, 24/7, ensuring we're always there to meet your needs

Affordable & Cost Effective

No user fees, no licenses. We provide simple, fair, and affordable pricing.

Globally Trusted

Bringing the power of ERPNext to ZATCA Compliance. ERPNext is trusted by 10,000+ global companies across industries.

100,000+ Invoices Cleared

Our proven ERPNext ZATCA Phase 2 E-Invoicing Software has cleared over 100,000 zatca invoices for 20+ customers in Saudi Arabia

You've Made it this Far; We Should Talk!

Are you in search of a ERPNext ZATCA Phase 2 solution backed by a global partner and trusted software? Whether you need a straightforward accounting solution or a comprehensive ERP system that handles all your business processes, we’ve got you covered. As a global software firm with decades of experience in the Kingdom and ERP solutions, we’re here to support your needs.

Frequently Asked

Questions

Find answers to common questions about ERPNext and its features.

FAQ

All businesses operating in Saudi Arabia, regardless of their size or industry, are required to use ZATCA E-Invoicing for issuing invoices electronically.

ZATCA E-Invoicing is mandatory to enhance transparency, reduce tax evasion, and modernize the tax system in Saudi Arabia. It helps in automating invoicing processes and ensures accurate reporting of financial transactions.

Some benefits of using ZATCA E-Invoicing include:

- Simplified and streamlined invoicing processes

- Reduced paperwork and administrative burden

- Enhanced accuracy and transparency in financial transactions

- Improved compliance with tax regulations

- Faster invoice processing and payment cycles

ZATCA E-Invoicing works by integrating businesses’ invoicing systems with the government’s electronic platform. When a business generates an invoice, it is submitted electronically to ZATCA for validation and authentication before being issued to the recipient.

ZATCA E-Invoicing is crucial for businesses in Saudi Arabia to comply with local regulations. It helps in the transition from traditional paper-based invoicing to a digital system, improving efficiency, reducing errors, and ensuring accurate tax reporting.

Key features include automated invoice generation, validation against ZATCA requirements, secure digital signatures, real-time tracking of invoices, and comprehensive reporting functionalities. These features collectively streamline the invoicing process and enhance compliance.

Non-compliance with ZATCA E-Invoicing requirements may result in penalties imposed by the tax authorities. These penalties can include fines, suspension of business activities, or other legal consequences.

Yes, ZATCA E-Invoicing can be integrated with existing accounting or ERP (Enterprise Resource Planning) systems used by businesses. Integration helps in automating the invoicing process and ensures seamless compliance with tax regulations.

For more information about ZATCA E-Invoicing, businesses can visit the official website of the Zakat, Tax, and Customs Authority or contact their local ZATCA office for assistance.

Beveren Software is one of the best Zatca approved E-invoicing solutions company in Saudi Arabia. Book a free demo.

Businesses need to ensure that their invoicing systems are compatible with the ZATCA KSA E-Invoicing platform. This includes having a secure and compliant electronic invoicing solution that meets ZATCA’s technical specifications.